The proprietary trading sector is booming, but with opportunity comes the challenge of navigating dozens of platforms—all promising to launch your trading career. For aspiring prop traders, choosing the right funded account program can mean the difference between scalable income and endless frustration. If you’re determined to join the ranks of professional traders in 2025, understanding what makes a great funded trading program is critical.

Why Funded Trading Programs Are More Popular Than Ever

Funded trading programs allow skilled traders to access firm capital, eliminating the need for large personal deposits. Instead of risking your own savings, you prove your skills in a structured challenge—then trade a live account within clear risk guidelines. The transparency, lower barriers to entry, and career growth potential have helped programs like those at FundedFirm attract a new generation of disciplined traders.

Essential Qualities of Leading Funded Trading Platforms

1. Transparent and Fair Trading Rules

A great funded program puts fairness and clarity first. Look for comprehensive rules on drawdown limits, daily loss maximums, position sizes, and profit targets. Clearly defined parameters help you trade with confidence and focus on process-driven success.

- Transparent programs foster trust; vague or hidden rules create confusion and costly mistakes.

- The industry’s most respected platforms publish their evaluation criteria and risk controls plainly, helping you prepare and strategize for consistent results.

2. Flexible Program Structures

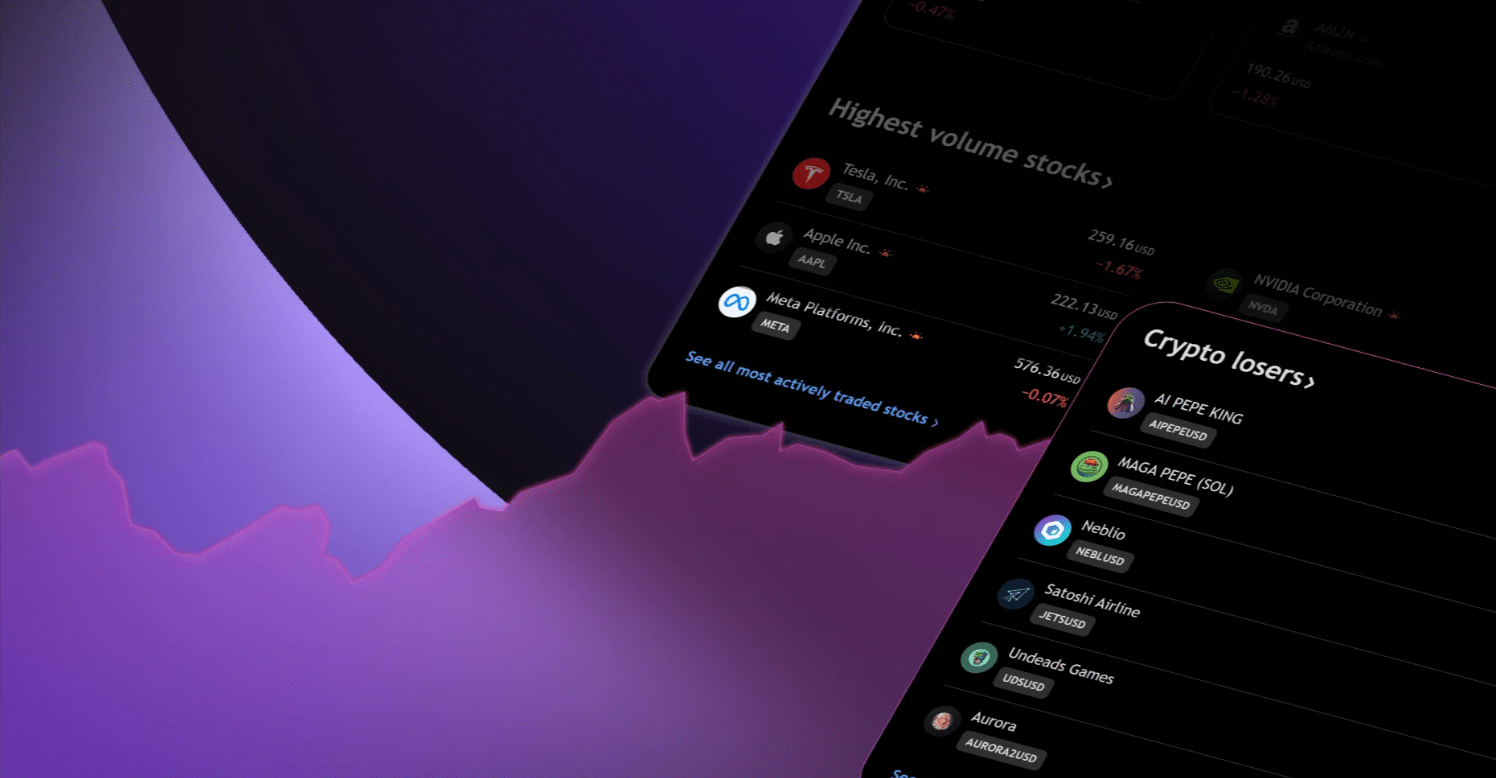

Every trader is unique—so top funded platforms offer a variety of account sizes, asset classes (like forex, indices, and commodities), and trading styles. You should be able to find a program that matches your personal goals, whether you’re a cautious swing trader or an aggressive day trader.

3. Fast, Reliable Payouts

In 2025, instant withdrawals are becoming the standard among leading prop trading firms. You should expect payouts within hours, not weeks, as a sign of a trustworthy partner.

- Reliable payouts signal firm commitment to supporting traders’ financial goals.

- Delays or overly complicated withdrawal processes should raise red flags.

4. Support and Community

Skill development is a journey, not a destination. The best platforms invest in traders with educational resources, mentorship, and active communities. Access to webinars, trading competitions, and chat forums helps accelerate your growth and keeps you motivated during tough market periods.

5. Real Trader Success Stories

Look for platforms that highlight genuine success stories and provide data-backed evidence of traders achieving lasting results. These stories offer inspiration and prove that structured discipline really pays off. For example, see how Sunil Kadire’s focus on process—and adherence to a program’s risk structure—led to a consistent funded income in the engaging case study “How Sunil Kadire Turned Consistency into Capital”.

Red Flags When Comparing Funded Programs

- Hidden Fees: Watch out for surprise charges during evaluations or payouts.

- Lack of History: New or unproven firms may not provide the stability and reliability you need.

- Vague Rulebooks: If rules aren’t clear, you run the risk of disqualification after success.

- Unresponsive Support: Poor customer service may leave you stranded during critical phases.

Practical Steps to Choose the Best Program

- Investigate Firm Reputation: Read reviews, case studies, and trader testimonials on reputable platforms.

- Understand the Rulebook: Know your loss thresholds, allowed trading hours, and profit requirements.

- Backtest Your Plan: Test strategies on demo platforms before tackling the live challenge.

- Engage with the Community: Leverage available educational and community resources.

Why FundedFirm Stands Out

If you’re ready to take your trading to the next level, FundedFirm offers trader-centric funded programs, instant payouts, transparent rulebooks, and a supportive global community. Their proven approach empowers both new and experienced traders to grow with real capital, clear accountability, and robust educational support.

Ready to fuel your trading ambitions? Explore FundedFirm’s funded account programs today and discover how the right structure, support, and capital access can transform your trading journey.